Is Bitcoin a Safe Investment?

Bitcoin, the world’s first decentralized cryptocurrency, has captivated investors, technologists, and policymakers since its inception in 2009.

With its meteoric price surges and dramatic corrections, Bitcoin has become a symbol of both opportunity and risk. As of July 2025, its market capitalization exceeds $1 trillion, and it is increasingly integrated into mainstream finance.

However, the question remains: Is Bitcoin a safe investment? This article examines the risks, rewards, and factors influencing Bitcoin’s safety as an investment, offering a balanced perspective for potential investors.

Understanding Bitcoin’s Appeal

Bitcoin’s allure lies in its unique characteristics. Unlike traditional currencies, it operates on a decentralized blockchain, free from government or bank control.

Its fixed supply of 21 million coins, enforced by its protocol, creates scarcity, positioning it as a potential hedge against inflation. Institutional adoption—by companies like MicroStrategy, Tesla, and Bitcoin exchange-traded funds (ETFs)—has bolstered its legitimacy, attracting both retail and institutional investors.

Bitcoin’s historical returns are staggering. From a value of less than $1 in 2010 to peaks above $60,000 in 2023 and 2024, early investors reaped enormous gains.

Its role as “digital gold” and its growing use in regions with unstable currencies further enhance its appeal. However, high rewards come with high risks, and understanding these is crucial for assessing its safety.

Risks of Investing in Bitcoin

1. Price Volatility

Bitcoin’s price is notoriously volatile. For example, it surged to nearly $69,000 in November 2021, only to crash below $17,000 by late 2022. As of July 2025, prices fluctuate between $50,000 and $80,000, driven by market sentiment, macroeconomic factors, and regulatory news. This volatility can lead to significant losses, especially for short-term investors or those unprepared for sudden drops.

2. Regulatory Uncertainty

Governments worldwide have adopted varied stances on Bitcoin. While countries like El Salvador embraced it as legal tender in 2021, others, such as China, have imposed strict bans. Regulatory crackdowns, tax policies, or anti-money laundering measures could restrict Bitcoin’s use or depress its value. In 2025, ongoing debates about cryptocurrency regulation in major economies like the U.S. and EU add uncertainty, potentially impacting investor confidence.

3. Security Risks

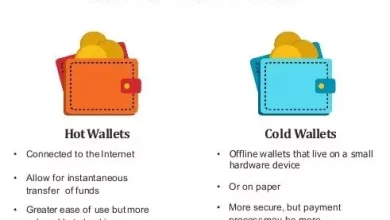

Bitcoin’s decentralized nature makes it secure in theory, but the ecosystem is vulnerable. Exchange hacks, such as the 2014 Mt. Gox collapse, which lost 850,000 BTC, and phishing scams have cost investors billions. While secure storage solutions like hardware wallets mitigate risks, human error—such as losing private keys—can result in permanent loss of funds. In 2025, cybersecurity remains a critical concern, especially for novice investors.

4. Environmental and Ethical Concerns

Bitcoin’s proof-of-work (PoW) mining consumes significant energy, raising environmental concerns. Critics argue that its carbon footprint, driven by energy-intensive mining operations, undermines its appeal. Although initiatives like renewable energy mining are gaining traction, negative perceptions could deter socially conscious investors or prompt regulatory restrictions.

5. Market Manipulation

Bitcoin’s relatively small market compared to traditional assets makes it susceptible to manipulation. “Whale” investors with large holdings can influence prices, and pump-and-dump schemes have been documented. Lack of centralized oversight means market irregularities are harder to police, posing risks for retail investors.

6. Competition and Obsolescence

Bitcoin faces competition from thousands of cryptocurrencies, such as Ethereum, Solana, and stablecoins, which offer different functionalities. Technological advancements or the rise of central bank digital currencies (CBDCs) could challenge Bitcoin’s dominance. While its first-mover advantage and network effect are strong, the risk of obsolescence cannot be ignored.

Factors Supporting Bitcoin’s Safety

1. Decentralization and Security

Bitcoin’s blockchain is one of the most secure networks globally, with no successful attacks on its core protocol since 2009. Its decentralized structure reduces reliance on single points of failure, unlike traditional financial systems. The network’s security strengthens as more miners join, making it increasingly resilient.

2. Institutional Backing

The entry of institutional investors has enhanced Bitcoin’s credibility. Companies like BlackRock and Fidelity offer Bitcoin ETFs, providing regulated exposure. Corporate treasuries holding Bitcoin signal long-term confidence, potentially stabilizing prices. As of 2025, institutional allocations continue to grow, reducing perceptions of Bitcoin as a speculative gamble.

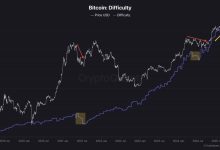

3. Scarcity and Halving Events

Bitcoin’s capped supply and periodic halving events (e.g., 2020, 2024) reduce the issuance of new coins, reinforcing its scarcity. This deflationary model appeals to investors seeking protection against fiat currency devaluation, especially in inflationary environments. Historical data shows price increases following halvings, though past performance is not a guaranteed predictor.

4. Growing Adoption

Bitcoin’s use cases are expanding. It is accepted by merchants, integrated into payment systems like PayPal, and used for remittances in developing economies. The Lightning Network, a second-layer solution, improves transaction speed and cost, enhancing its utility. Adoption trends suggest Bitcoin is transitioning from a speculative asset to a practical financial tool.

5. Community and Resilience

Bitcoin’s global community of developers, miners, and advocates ensures its ongoing development and resilience. Despite bear markets, hacks, and bans, Bitcoin has survived for over 15 years, outlasting many competitors. Its open-source nature allows continuous improvements, such as Taproot (2021), which enhanced privacy and efficiency.

Strategies for Safer Bitcoin Investment

To mitigate risks, investors can adopt prudent strategies:

-

Diversification: Allocate only a small portion of a portfolio to Bitcoin (e.g., 1–5%) to limit exposure to volatility.

-

Secure Storage: Use hardware wallets or reputable custodians to protect funds from hacks or loss.

-

Long-Term Perspective: Adopt a “hold” strategy to weather short-term volatility, as Bitcoin’s value has historically trended upward over time.

-

Research and Education: Understand Bitcoin’s technology, market dynamics, and risks before investing.

-

Stay Informed: Monitor regulatory developments and market trends to anticipate potential impacts.

Bitcoin in 2025: A Balanced View

As of July 2025, Bitcoin is neither a guaranteed safe haven nor a reckless gamble. Its price stability has improved compared to earlier years, but volatility persists. Institutional adoption and technological advancements bolster its case, yet regulatory, security, and environmental challenges remain.

For risk-tolerant investors with a long-term horizon, Bitcoin offers significant potential, particularly as a hedge against inflation or currency instability. However, those seeking stability or quick profits may find it unsuitable.

Comparison to Traditional Investments

Compared to stocks, bonds, or gold, Bitcoin is riskier due to its volatility and regulatory uncertainty. However, its uncorrelated returns make it a valuable diversifier. Unlike gold, Bitcoin is easily transferable and divisible, but it lacks the physical tangibility of traditional assets. Bonds offer predictable returns but are exposed to interest rate risks, while Bitcoin’s returns are less predictable but potentially higher.

Expert Opinions

Financial experts are divided. Proponents like Cathie Wood of ARK Invest argue Bitcoin could reach $1 million by 2030, citing its scarcity and adoption. Critics like Warren Buffett dismiss it as “rat poison squared,” emphasizing its lack of intrinsic value. The truth likely lies in between: Bitcoin’s value depends on continued adoption, technological stability, and regulatory clarity.