A Step-by-Step Guide to Buying Your First Crypto

Cryptocurrency has become a global phenomenon, with Bitcoin (BTC), Ethereum (ETH), and thousands of other digital assets offering new opportunities for investment and financial innovation.

As of July 2025, the crypto market is thriving, with Bitcoin trading between $50,000 and $80,000 and growing mainstream adoption.

For beginners, buying your first cryptocurrency can seem intimidating due to technical jargon, security concerns, and market volatility.

This step-by-step guide simplifies the process, walking you through how to buy your first crypto safely and confidently, covering preparation, choosing platforms, making a purchase, and securing your assets.

Step 1: Understand the Basics

Before purchasing cryptocurrency, familiarize yourself with key concepts:

-

What Is Cryptocurrency? A digital currency operating on a decentralized blockchain, like Bitcoin or Ethereum, free from central bank control.

-

Volatility: Crypto prices can fluctuate significantly. For example, Bitcoin dropped from $69,000 in 2021 to $17,000 in 2022 before rebounding to $107,411 in 2024.

-

Wallets: Tools to store and manage crypto, holding private keys that prove ownership.

-

Exchanges: Platforms where you buy, sell, or trade crypto, such as Coinbase or Binance.

-

Risks: Scams, hacks, and price volatility are common, so only invest what you can afford to lose.

Action: Read beginner-friendly resources like Binance Academy, CoinDesk, or The Bitcoin Standard by Saifedean Ammous. Follow crypto news on platforms like X to stay informed.

Step 2: Set Your Goals and Budget

Define why you’re buying crypto and how much you’re willing to invest:

-

Investment Goals: Are you seeking long-term growth (e.g., holding Bitcoin as a store of value), short-term trading, or exploring DeFi/NFTs?

-

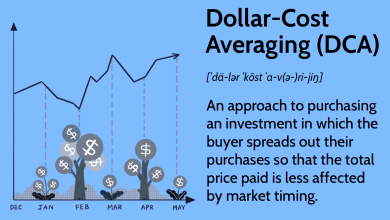

Budget: Only invest disposable income. A common rule is to allocate 1–5% of your portfolio to crypto to manage risk.

-

Risk Tolerance: Be prepared for price swings and potential losses.

Action: Decide on an initial investment (e.g., $50–$500) and stick to it. Avoid using borrowed money or funds needed for essentials.

Step 3: Choose a Cryptocurrency

Select a cryptocurrency based on your goals and research:

-

Bitcoin (BTC): Ideal for beginners due to its stability, widespread acceptance, and “digital gold” status.

-

Ethereum (ETH): Great for those interested in DeFi or NFTs, with a robust ecosystem.

-

Stablecoins (e.g., USDT, USDC): Pegged to fiat currencies like the USD, offering lower volatility.

-

Altcoins (e.g., Solana, Cardano): Higher risk but potential for growth, suitable for diversified portfolios.

Action: Start with established coins like Bitcoin or Ethereum to minimize risk. Research projects on CoinMarketCap or CoinGecko for market data and project details.

Step 4: Select a Reputable Exchange

Crypto exchanges are platforms where you can buy cryptocurrency using fiat (e.g., USD, EUR) or other cryptos. Choose one based on security, fees, and ease of use:

-

Centralized Exchanges (CEXs): User-friendly, ideal for beginners.

-

Coinbase: Simple interface, beginner-friendly, regulated in many countries.

-

Binance: Wide range of coins, low fees, but more complex.

-

Kraken: Strong security, good for both beginners and advanced users.

-

-

Decentralized Exchanges (DEXs): Like Uniswap, these require a wallet and more technical knowledge, better for advanced users.

-

Peer-to-Peer Platforms: LocalBitcoins or Paxful connect you directly with sellers but may have higher fees.

Action: Choose a CEX like Coinbase or Binance for your first purchase. Verify the platform’s legitimacy by checking its website, reviews, and security history.

Step 5: Create and Verify an Account

Most exchanges require identity verification to comply with regulations (Know Your Customer, or KYC):

-

Sign Up: Visit the exchange’s official website or app and create an account with your email and a strong password.

-

Complete KYC: Submit identification (e.g., passport, driver’s license) and proof of address. This may take a few hours to days.

-

Enable Security: Set up two-factor authentication (2FA) using an authenticator app (e.g., Google Authenticator) for added protection.

Action: Register on your chosen exchange, complete KYC, and enable 2FA. Double-check the URL to avoid phishing scams.

Step 6: Fund Your Account

To buy crypto, you need to deposit funds into your exchange account:

-

Fiat Deposit: Link a bank account, debit/credit card, or use payment services like PayPal (where supported). Bank transfers are often cheaper but slower.

-

Crypto Deposit: If you already own crypto, transfer it to the exchange’s wallet address.

-

Fees: Check deposit fees, as some methods (e.g., credit cards) charge 2–4%.

Action: Deposit a small amount (e.g., $50) to test the process. Confirm the deposit is reflected in your account balance.

Step 7: Buy Your First Crypto

Once your account is funded, you’re ready to buy:

-

Navigate to the Trading Section: Find the “Buy/Sell” or “Trade” tab on the exchange.

-

Select Your Crypto: Choose Bitcoin, Ethereum, or your preferred coin.

-

Choose Order Type:

-

Market Order: Buy at the current market price (fast but may include a small premium).

-

Limit Order: Set a specific price to buy at, which may take longer to execute.

-

-

Enter Amount: Specify how much you want to buy (e.g., $100 worth of BTC).

-

Confirm Purchase: Review fees (typically 0.1–2%) and confirm the transaction.

Action: Start with a market order for simplicity. Buy a small amount of Bitcoin or Ethereum to test the process.

Step 8: Store Your Crypto Safely

After purchasing, decide where to store your crypto:

-

Exchange Wallet: Convenient for small amounts or frequent trading but risky due to potential hacks (e.g., Mt. Gox in 2014).

-

Software Wallet (Hot Wallet): Apps like MetaMask or Trust Wallet are user-friendly but require device security.

-

Hardware Wallet (Cold Wallet): Devices like Ledger Nano X or Trezor offer offline storage, ideal for large amounts or long-term holding.

Action: For amounts above $500, transfer your crypto to a hardware wallet. Write down the seed phrase and store it offline in a secure location (e.g., a safe).

Step 9: Monitor and Manage Your Investment

-

Track Prices: Use apps like CoinGecko or Blockfolio to monitor your crypto’s value.

-

Learn About Taxes: Crypto gains may be taxable in your country. Keep records of purchases and sales.

-

Stay Informed: Follow market trends, regulatory news, and project updates via CoinDesk, X, or Reddit’s r/cryptocurrency.

-

Avoid Emotional Decisions: Don’t panic-sell during dips or chase hype during surges.

Action: Set up price alerts and check your portfolio weekly. Research tax laws in your region to stay compliant.

Step 10: Expand Your Knowledge

To grow as a crypto investor:

-

Explore Use Cases: Try sending crypto to another wallet, staking Ethereum, or buying an NFT.

-

Learn Technical Analysis: Study charts, moving averages, or RSI to understand price trends.

-

Join Communities: Engage with crypto communities on Discord or X, but verify information independently.

-

Diversify: Once comfortable, consider adding other coins like Solana or stablecoins to your portfolio.

Action: Take a free course on Binance Academy or Coursera to deepen your understanding of blockchain and crypto.

Common Mistakes to Avoid

-

Falling for Scams: Beware of phishing emails, fake apps, or “get-rich-quick” schemes.

-

Ignoring Security: Never share your private key or seed phrase. Use 2FA and reputable platforms.

-

Overinvesting: Only risk what you can afford to lose due to crypto’s volatility.

-

FOMO Buying: Avoid purchasing during price spikes without research.

-

Neglecting Backups: Always back up your seed phrase in multiple secure locations.

The Crypto Landscape in 2025

As of July 2025, the crypto market is more accessible than ever. Institutional adoption, like Bitcoin ETFs and corporate treasuries, has boosted legitimacy, while regulatory clarity in some regions encourages participation. However, scams, volatility, and regulatory risks persist. Bitcoin’s price stability between $50,000 and $80,000 and Ethereum’s growth in DeFi make them safe starting points for beginners.