What Affects Cryptocurrency Prices?

Cryptocurrency prices are notoriously volatile, with dramatic swings that captivate investors and challenge analysts.

As of July 24, 2025, Bitcoin (BTC) trades between $50,000 and $80,000, Ethereum (ETH) targets $4,000–$6,000, and altcoins like Solana and Cardano experience rapid fluctuations.

Understanding what drives these price movements is crucial for investors, traders, and enthusiasts navigating the crypto market. This article explores the key factors affecting cryptocurrency prices, from market dynamics to technological and external influences, providing a comprehensive guide to the forces shaping this dynamic asset class.

1. Supply and Demand

The fundamental economic principle of supply and demand is a primary driver of cryptocurrency prices.

-

Limited Supply: Many cryptocurrencies, like Bitcoin, have a fixed supply cap (21 million coins). As demand rises, scarcity drives prices upward, especially after events like Bitcoin’s halving (e.g., 2024 halving reduced block rewards to 3.125 BTC).

-

Circulating Supply: Tokens locked in staking (e.g., Ethereum’s 25% staked ETH in 2025) or held by long-term investors (“HODLers”) reduce available supply, increasing prices if demand remains constant.

-

Demand Drivers: Adoption by institutions, retail investors, or use in DeFi and NFTs boosts demand. For example, Ethereum’s price rises with increased gas fees for dApps.

Impact: High demand with limited supply fuels bull runs, while oversupply or reduced interest triggers declines.

2. Market Sentiment and Speculation

Cryptocurrency markets are heavily influenced by investor psychology and speculation.

-

Social Media and News: Platforms like X amplify sentiment, with viral posts or influencer endorsements sparking rallies (e.g., #ETHto10K trends in 2025). Negative news, like exchange hacks, can trigger sell-offs.

-

Fear of Missing Out (FOMO): Hype during bull markets drives retail investors to buy at peaks, inflating prices, as seen in Bitcoin’s 2024 surge to $107,411.

-

Fear, Uncertainty, and Doubt (FUD): Rumors of bans or technical issues can lead to panic selling, causing price drops.

Impact: Sentiment-driven volatility is amplified in crypto due to its relatively small market size compared to stocks or bonds.

3. Regulatory Developments

Government policies and regulations significantly affect crypto prices.

-

Positive Regulation: Clear frameworks, like U.S. approval of Bitcoin and Ethereum ETFs (2021–2023), boost investor confidence and prices.

-

Restrictive Policies: Bans or crackdowns, such as China’s crypto restrictions, depress prices by limiting adoption and trading.

-

Taxation and Compliance: New tax rules or anti-money laundering (AML) requirements can deter investors, impacting demand.

Impact: Regulatory clarity drives institutional adoption, while uncertainty or bans can trigger market downturns.

4. Macroeconomic Factors

Broader economic conditions influence crypto prices, as cryptocurrencies are increasingly viewed as alternative investments.

-

Inflation and Currency Devaluation: High inflation, as seen in some economies in 2025, drives investors to Bitcoin as a hedge, boosting its price.

-

Interest Rates: Rising rates, like U.S. Federal Reserve hikes, reduce speculative investments in crypto, leading to price dips.

-

Economic Uncertainty: Global crises, such as recessions or geopolitical tensions, can increase demand for decentralized assets or reduce risk appetite, affecting prices both ways.

Impact: Crypto prices often correlate with macroeconomic trends, behaving like risk-on assets during bullish economies or safe havens during crises.

5. Technological Developments

Advancements in blockchain technology directly impact cryptocurrency prices.

-

Network Upgrades: Ethereum’s 2022 Proof of Stake transition and upcoming sharding (2026) enhance scalability and efficiency, boosting ETH’s value.

-

Security: Successful blockchain upgrades, like Bitcoin’s Taproot (2021), increase investor confidence, while vulnerabilities or hacks (e.g., smart contract exploits) depress prices.

-

Layer-2 Solutions: Technologies like the Lightning Network for Bitcoin or Optimism for Ethereum reduce transaction costs, driving adoption and prices.

Impact: Technological improvements signal long-term viability, attracting investors, while delays or failures erode trust.

6. Institutional Adoption

The entry of institutional investors has transformed the crypto market.

-

Corporate Investments: Companies like MicroStrategy and Tesla holding Bitcoin as a treasury asset signal mainstream acceptance, driving prices.

-

ETFs and Financial Products: Bitcoin and Ethereum ETFs, launched in 2021–2023, attract traditional investors, increasing demand.

-

Custodial Services: Institutional-grade custody solutions from firms like Fidelity enhance market stability.

Impact: Institutional buying creates bullish pressure, while sell-offs or hesitancy can lead to corrections.

7. Market Manipulation

Crypto markets are susceptible to manipulation due to their relatively low liquidity.

-

Whale Activity: Large holders (“whales”) can move prices by buying or selling significant amounts. For example, a whale dumping 10,000 BTC can trigger a crash.

-

Pump-and-Dump Schemes: Coordinated efforts to inflate prices of low-cap coins, often promoted on X, lead to artificial rallies followed by sharp drops.

-

Spoofing and Wash Trading: Some exchanges engage in artificial trading to inflate volumes, distorting price signals.

Impact: Manipulation causes short-term volatility, particularly for smaller altcoins, affecting retail investors.

8. Adoption and Use Cases

Real-world adoption drives demand for cryptocurrencies.

-

Payments and Remittances: Bitcoin’s use for cross-border transfers or Ethereum’s role in DeFi increases utility and demand.

-

DeFi and NFTs: Ethereum’s dominance in DeFi (over $100 billion TVL in 2025) and NFT marketplaces like OpenSea boosts ETH prices.

-

Merchant Acceptance: Companies like PayPal and Visa accepting crypto payments enhance legitimacy and demand.

Impact: Growing utility in payments, DeFi, or NFTs drives organic price growth, while stagnation reduces interest.

9. Competition Among Cryptocurrencies

The crypto market is highly competitive, with thousands of coins vying for attention.

-

Bitcoin vs. Altcoins: Bitcoin’s dominance (around 50% of market cap in 2025) influences altcoin prices. A Bitcoin rally often triggers an “altcoin season.”

-

Layer-1 Blockchains: Ethereum faces competition from Solana, Cardano, and Polkadot, which offer faster transactions or lower fees, impacting ETH’s market share.

-

Stablecoins: Coins like USDT and USDC provide stability, diverting capital from volatile assets during downturns.

Impact: Competition can divert investment from one crypto to another, affecting relative prices.

10. External Events and Black Swans

Unpredictable events can cause sudden price movements.

-

Hacks and Security Breaches: Exchange hacks (e.g., Binance 2019) or protocol vulnerabilities lead to sell-offs.

-

Geopolitical Events: Conflicts or sanctions can increase demand for decentralized assets or reduce risk appetite.

-

Technological Disruptions: Innovations like quantum computing could theoretically threaten blockchain security, though not imminent in 2025.

Impact: Black swan events cause rapid price swings, often amplifying volatility in an already speculative market.

Analyzing Price Movements

Analysts use several tools to understand and predict price trends:

-

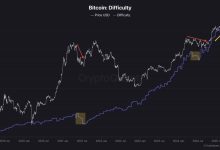

Technical Analysis: Charts, moving averages, RSI, and MACD identify patterns and momentum.

-

On-Chain Analysis: Metrics like active addresses, transaction volume, and staking data reflect network health.

-

Sentiment Analysis: Monitoring X posts or news sentiment gauges market mood.

-

Fundamental Analysis: Evaluates a project’s technology, team, and adoption potential.

For example, in July 2025, Ethereum’s 1 million daily active addresses and Bitcoin’s $10 billion daily transaction volume signal strong network activity, supporting bullish predictions.

Strategies for Navigating Price Volatility

-

Dollar-Cost Averaging (DCA): Invest fixed amounts regularly to reduce the impact of volatility.

-

Diversification: Spread investments across Bitcoin, Ethereum, stablecoins, and altcoins.

-

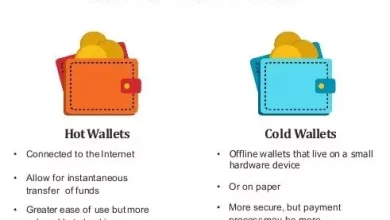

Secure Storage: Use hardware wallets (e.g., Ledger) to protect assets from exchange risks.

-

Stay Informed: Follow regulatory news, technological updates, and market trends via CoinDesk or X.

-

Risk Management: Only invest what you can afford to lose, given crypto’s high-risk nature.

The Crypto Market in 2025

As of July 24, 2025, the crypto market reflects a mix of optimism and caution.

Bitcoin’s post-2024 halving rally and Ethereum’s DeFi dominance drive bullish sentiment, but regulatory scrutiny and competition from Solana and others pose challenges.

Institutional adoption, like Bitcoin ETFs and corporate treasuries, adds stability, while sentiment on X fuels speculative spikes. Understanding these dynamics is key to anticipating price movements.